Each year, Modern Materials Handling conducts a Pallet Usage and Trending Survey. The results of the 2012 study are summarized in Bob Trebilcock’s recent Modern Materials Handling article, “The Pulse on Pallets.” This post highlights some the survey’s key findings and discusses the state of the pallet industry in 2012.

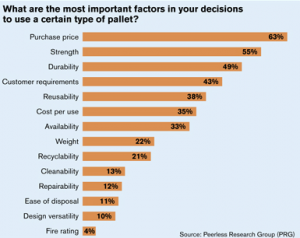

The survey results are compiled from 672 respondents representing a wide range of industries. In 2012, price is once again the most important selection criteria (63%), followed by strength (53%), and durability (49%).

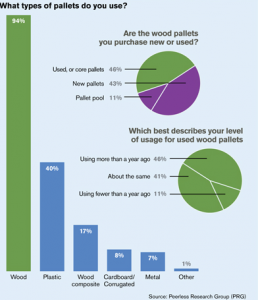

The combination of these three key considerations gives the continued upper hand to wood as the predominant material of choice (94%) followed by plastic (40%), wood composite (17%), cardboard/corrugated (8%) and metal (7%). Although plastic pallets continue to hold a major portion of markets share, demand for plastic and other alternatives materials is largely unchanged over last year. Although lower initial acquisition costs give a slight edge to recycled pallets (46%) over a preference for new pallets (43%), 31% of respondents observed declines in core quality, 17% found used and recycled pallets more expensive, and 21% of the survey participants noted that used pallets are in shorter supply.

58% of the respondents purchased pallets for domestic and export use in 2012, with 74% of survey participants citing Canada as a recipient of export shipments. The proposed termination of the bi-lateral US/Canada exemption from ISPM 15 standards should fuel higher demand for heat treated and alternative material pallets in the not-so-distant future.

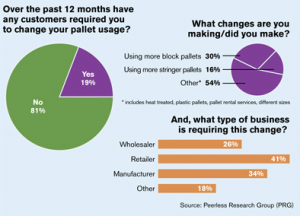

The survey also offers a fascinating look into pallet construction methods. Although much is made of the so-called Costco/Walmart effect, 81% of respondents claimed customers had NOT required a change in pallet construction techniques in 2012. For the remaining 19%, 30% are using more block pallets, 16% cited higher use of stringer pallets, and 54% are making greater use of heat treated pallets, plastic pallets, pallet rental companies, and different sizes.

Toward the end of the webcast, Dr. White shared thoughts from his recent trip to China. As labor costs continue to rise, the practice of floor loading (the practice of manually filling ocean going cargo containers with unpalletized boxes) will give way to unitized, palletized loads from the 20 million TEUs arriving from China each year. Dr. White also suggested that because it is most efficient to use a pallet specification common to the point of origin, there may be a new influx of Chinese pallets to augment the core pool in the United States.

Much of the information contained in the 2012 Pallet Survey suggests the industry is following many long established patterns and trends. Price sensitivity and a preference for wood remains king. At the same time, the study demonstrates the impact of ISPM-15 regulations and the need for heat treated wooden pallets or wood alternatives (e.g., presswood pallets) present a huge opportunity for growth in the years ahead. Companies poised to capitalize on the changing nature of the pallet industry will be in a prime position to assist customers with new requirements in 2013 and beyond.

At Litco, our complete line-up of export ready presswood, heat treated, plastic, and corrugated pallets give us the ultimate degree of flexibility to match customer requirements with the right pallet to carry your products safely on through the supply chain. For assistance, contact the pallet experts at Litco International for more information.